Prediction: This "Magnificent Seven" Stock Will Be the Biggest Winner of the AI Boom

Investors are flocking to artificial intelligence (AI) stocks these days because of the technology's potential to make companies more efficient and even transform certain industries. The idea is to identify tomorrow's winners today so that you can get in early and benefit from the growth to come. The AI market is expected to top $1 trillion by the end of the decade, so the opportunity for companies and investors could be vast.

The good news is that many companies are likely to thrive, thanks to AI, which should boost their earnings and, eventually, their share prices, too. But one company in particular is positioned to potentially benefit more than any other. It's a member of the elite group of technology stocks dubbed the "Magnificent Seven," a reference to the 1960 Western.

I predict that this stock will be the biggest winner of the AI boom over the long run. Let's take a closer look at the player that could score a win for your portfolio.

An e-commerce and cloud computing leader

When you think of AI, you may immediately think of the chipmakers that power these platforms. Many of them make great buys and are likely to excel in the near term, as well as the long term. But the company I expect to win the most uses AI to improve its own operations and sells AI tools to others. I'm talking about e-commerce and cloud computing powerhouse Amazon (NASDAQ: AMZN).

Over time, Amazon has built a vast fulfillment network, even doubling its size during the earlier stages of the pandemic to meet demand for essentials and general merchandise. The company uses AI in various ways to achieve efficiency and please the customer.

For example, Amazon's robotics team is building foundation AI models to manage logistic challenges in its facilities. The company already uses AI for tasks like determining the fastest delivery routes -- and this helps lower the cost to serve.

If you shop on Amazon, you're probably familiar with another Amazon AI effort -- the use of AI to present you with product suggestions based on your buying history.

These are just a few examples that should help the company lower costs over time and boost earnings. So Amazon may gain directly from applying AI to its operations.

AWS chips and Nvidia chips

But that's not all. Amazon Web Services (AWS), the company's cloud computing business and biggest profit driver, sells AI products and tools to its customers. AWS offers its own innovations, like training and inference chips for the cost-conscious client, as well as AI products and services from chip leaders like Nvidia.

AWS has something for everyone. This includes basics, like compute for customers interested in launching their own large language models (LLMs), to a fully managed service that allows customers to customize already existing LLMs from top providers.

Finally, Amazon is involved in applications, too, with the goal of building generative AI apps across all of the company's consumer businesses. Examples include the new Rufus AI-powered shopping assistant and tools to help advertisers design their campaigns.

Amazon's position as the world's leading cloud services company gives it a significant advantage: its huge audience. Customers are unlikely to go elsewhere with AI projects when they already use AWS. Considering AWS' broad range of products and services, customers are likely to find what they need there.

A track record of growth

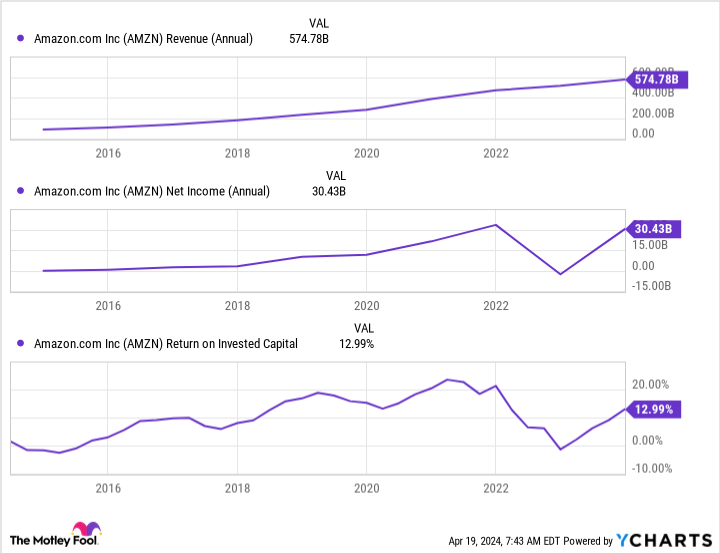

Amazon has a proven track record of earnings growth, along with growth in return on invested capital, showing it has invested wisely over time.

The company also has shown it could quickly recover and grow after times of difficulty. We saw this over the past couple of years when higher interest rates weighed on earnings, but Amazon revamped its cost structure and returned to earnings growth.

Amazon is well positioned to invest in AI and benefit in the two ways mentioned above from this transformational technology, spurring a whole new growth story for the company down the road. I predict Amazon will be the biggest winner of the potential AI revolution, so investing in this top stock now could be a fantastic move.

Should you invest $1,000 in Amazon right now?

Before you buy stock in Amazon, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Amazon wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $466,882!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 22, 2024

John Mackey, former CEO of Whole Foods Market, an Amazon subsidiary, is a member of The Motley Fool's board of directors. Adria Cimino has positions in Amazon. The Motley Fool has positions in and recommends Amazon and Nvidia. The Motley Fool has a disclosure policy.

Prediction: This "Magnificent Seven" Stock Will Be the Biggest Winner of the AI Boom was originally published by The Motley Fool