If You Invested $5,000 When Dell Went Public Again in 2018, This Is How Much You Would Have Today

Computing company Dell Technologies (NYSE: DELL) went public way back in 1988. The business performed well for more than a decade, and the stock performance was sensational going into the dot-com bubble of the late 1990s. At one point, Dell was valued at around $100 billion.

However, from the year 2000 until 2013, the business languished, and the stock dropped roughly 75% in value. Finally, the company's founder, Michael Dell, worked out a deal to take the company private again.

The public history for Dell seemed to be over. But in 2018, it went public once again at about $23 per share (adjusted for subsequent stock splits). Here's why it's been off to the races ever since.

But first, here's what happened with Dell 1.0

Dell's first foray as a public company ended poorly because of multiple failures. First, it's mostly a PC business. But it was disrupted by the rise of smartphones and tablets, and the company didn't successfully launch its own mobile devices.

Dell did rightly recognize its need to supplement its low-margin PC hardware business with high-margin software services. And from 2008 through 2023, it went on an acquisition spree, buying more than 20 other companies, according to Reuters. But this was pricey and didn't grow the business as expected.

Finally, Michael Dell decided to focus more intensely on the company's problems by going private.

Why Dell 2.0 has worked out well

On Dec. 28, 2018, Dell returned to the stock market as a publicly traded company, but it wasn't a no-brainer buy. For starters, the company's ownership structure was complicated because of all of the private investors involved. Moreover, in the six months ending on Aug. 3, 2018, Dell had a pro forma net loss of $1.2 billion.

Shortly after returning to the market, Michael Dell told CNBC that the company had paid down $14 billion in debt while private. But it had also invested $21 billion in research and development (R&D) during that time. Investing in R&D is good, but that's a lot of money, and the return on investment was questionable.

Because of these questions, Dell returned to the market at a dirt cheap valuation of just 0.2 times its trailing sales. In short, investor confidence was low.

Since then, investors have warmed to Dell stock for two big reasons. First, the company has massively grown profits. When it returned to the market, it was reporting operating losses. However, from its fiscal 2017 through its fiscal 2024 (which ended on Feb. 2), the company's high-margin services revenue more than doubled to $24 billion. Moreover, management cut operating expenses during this time.

Thanks to both high-margin growth and lower expenses, Dell had operating income of $5.2 billion in fiscal 2024, a sharp improvement from its losses when it went public again.

Second, investors have warmed to Dell stock more recently because of its products that address the artificial intelligence (AI) trend. The company sells AI-optimized servers, and enterprises are suddenly quite interested. In the fourth quarter of its fiscal 2024, Dell had a $2.9 billion backlog for these products, almost double what its backlog was in the third quarter.

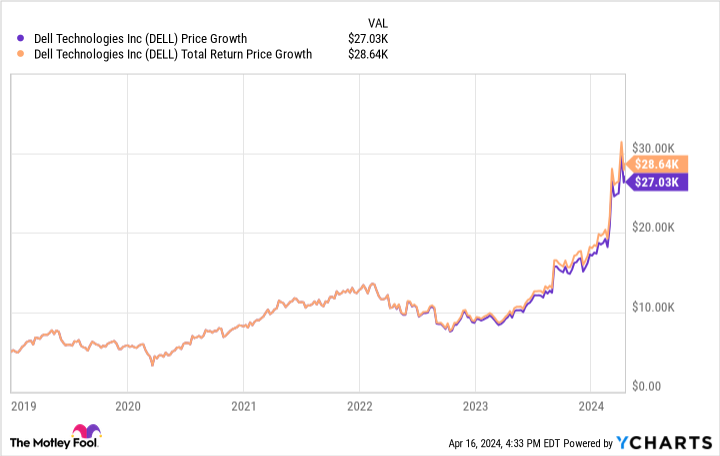

Operating-profit growth and its AI potential have boosted investor confidence in Dell stock. Shares have consequently soared since going public again. For those who invested $5,000 back in 2018, their stake is worth $27,000 today. And if dividends were reinvested, their investment is worth nearly $29,000.

Why I'm cautious on Dell stock now

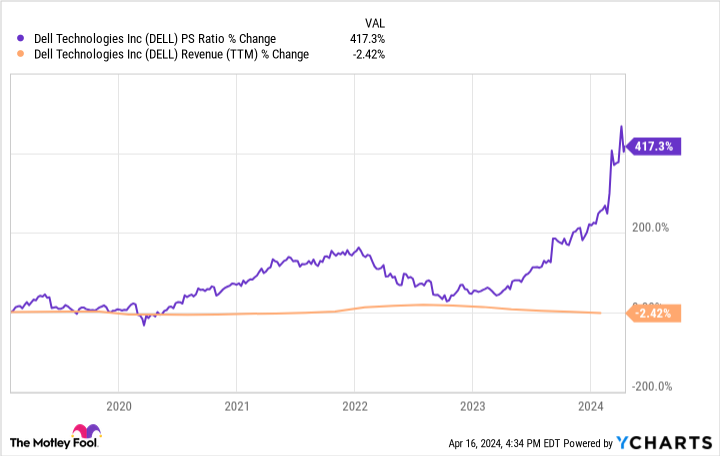

It's true that Dell's profits are way up, and that's important. But trailing-12-month revenue is actually slightly down over the last six years, as the chart below shows. The difference for shareholders, therefore, is its valuation: It's price-to-sales (P/S) ratio is up more than 400%.

In other words, the success of Dell stock has more to do with valuation than the business, and that gives me pause.

To be more confident with an investment in Dell, I'd like to see better growth. Granted, its AI business is clearly growing fast, but the company's fiscal 2024 revenue was $88 billion. Therefore, it's AI backlog of $2.9 billion is quite small by comparison.

Moreover, it's unclear how sustainable Dell's AI growth is. Its products are for building on-premise AI capabilities. Companies may forgo that path under adverse economic conditions due to the cost.

In closing, Dell stock has been a big-time winner for investors since going public again. But I think it's a good idea to sit on the sidelines today, waiting for either a better valuation or better clarity regarding the growth potential of the business.

Should you invest $1,000 in Dell Technologies right now?

Before you buy stock in Dell Technologies, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Dell Technologies wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $514,887!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 15, 2024

Jon Quast has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

If You Invested $5,000 When Dell Went Public Again in 2018, This Is How Much You Would Have Today was originally published by The Motley Fool