Forget Nvidia: 2 Artificial Intelligence (AI) Stocks to Buy Now

Nvidia has enjoyed being at the top of the artificial intelligence (AI) world for some time. Its graphics processing units (GPUs) are best-in-class for handling AI workloads, and many companies have purchased these GPUs by the thousands to set up their AI computing infrastructure. But these GPUs aren't cheap. Nvidia's flagship GPU, the H100, is rumored to cost around $30,000 to $40,000 apiece.

The margins on these units are quite impressive, which has driven Nvidia's profits through the roof. But when there's that big of a gold mine that one company is sitting on, challengers will surely arise to grab some of the market.

Meta Platforms (NASDAQ: META) and Alphabet (NASDAQ: GOOG) (NASDAQ: GOOGL) are two of the latest challengers, and their new products are sure to take over some of Nvidia's market share.

1. Meta Platforms

Meta Platforms is better known by some of the social media companies it owns: Facebook, Instagram, Threads, WhatsApp, and Messenger. These companies are essentially advertising platforms at their cores, so Meta devoted a large chunk of its AI resources to developing models that increase ad performance. Better products normally come with a premium price tag, so this effort could boost Meta's business over the long haul.

Because Meta's workloads are highly specific and specialized to the company, it developed its own chip, the Meta Training and Inference Accelerator (MTIA). It developed this chip because GPUs (Nvidia's products that power AI model training) weren't suited to run their workloads optimally. This kind of product development to create a one-off chip infrastructure to optimize workloads could become an issue for Nvidia, as many of its largest customers have the resources to develop these products.

Furthermore, Meta is directly challenging Nvidia with a new product announcement as it's also developing a next generation GPU. While the announcement didn't give much information about this product, it shows that Meta is gunning for some of Nvidia's market share.

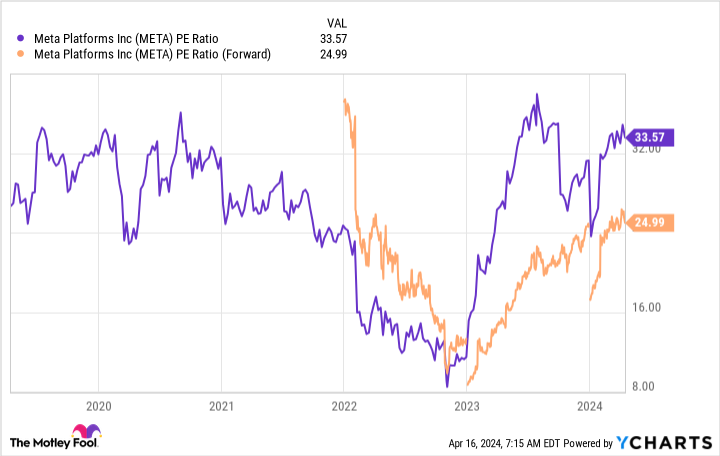

However, Meta's stock isn't trading like any of these investments will work out.

At 25 times forward earnings, Meta is still valued around the same levels as it has been for the past five years when it was just a social media company. As a result, you can buy Meta's stock for its advertising business and get the upside of its AI infrastructure developments for free.

That seems like a fantastic investment proposition, which makes Meta stock a strong buy.

2. Alphabet

Alphabet is similarly challenging Nvidia. It recognized the same challenge Meta did: GPUs are not perfectly suited for AI workloads when the workload has been set up efficiently. That's why Alphabet created its tensor processing unit (TPU) and recently unveiled its fifth version.

This version integrates a CPU (central processing unit) and can achieve twice the performance of the last generation of a TPU. Google Cloud's vice president, Mark Lohmeyer, believes this will make it easier for customers to switch their workloads to Google Cloud. Unlike Nvidia's GPUs, which can be bought, Alphabet's can only be used by Google Cloud customers.

However, this has been a promising proposition for many AI companies. Roughly 70% of generative AI unicorns (private companies worth at least $1 billion) are already Google Cloud customers. With that large of a key customer base already, it shows prospective customers the benefits of running their AI workloads on Google Cloud.

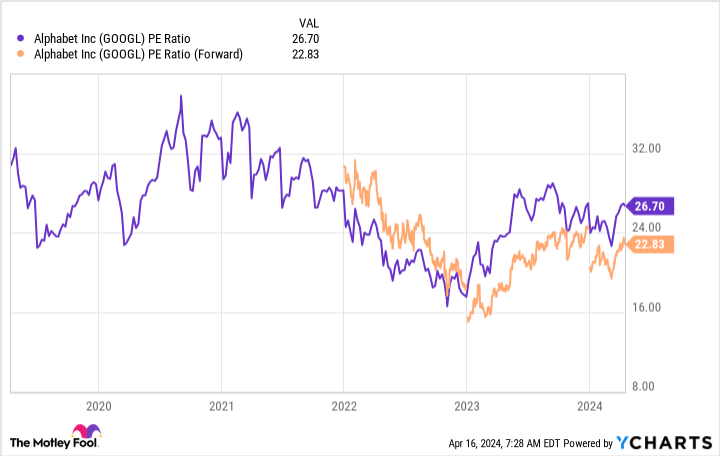

Alphabet is in a similar boat to Meta, as it's only priced for its historical businesses.

Alphabet's stock is fairly cheap with its trailing and forward price-to-earnings (P/E) ratio still below historical levels. With the potential for the Google Cloud business to improve thanks to better AI workload training hardware, there's still plenty of room for upside in the stock, making it a strong buy.

Should you invest $1,000 in Meta Platforms right now?

Before you buy stock in Meta Platforms, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Meta Platforms wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $518,784!*

Stock Advisor provides investors with an easy-to-follow blueprint for success, including guidance on building a portfolio, regular updates from analysts, and two new stock picks each month. The Stock Advisor service has more than quadrupled the return of S&P 500 since 2002*.

*Stock Advisor returns as of April 15, 2024

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool's board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to Meta Platforms CEO Mark Zuckerberg, is a member of The Motley Fool's board of directors. Keithen Drury has positions in Alphabet and Meta Platforms. The Motley Fool has positions in and recommends Alphabet, Meta Platforms, and Nvidia. The Motley Fool has a disclosure policy.

Forget Nvidia: 2 Artificial Intelligence (AI) Stocks to Buy Now was originally published by The Motley Fool